Why Smart Investors Are Looking to Asian Markets

47's asinine tariff war is giving massive advantages to Asia in the US

It is the view of the author that this information is to be used for informational purposes only. This is not investment advice nor is this the position of a fiduciary. It is also the position of this author that the person currently holding the office of US President is not worthy of a name and is not acting as a president, instead acts as a dictator. Therefor this author will only refer to this person as 47 and their actions will be referred to as the republican regime (not administration).

Basics of Understanding

47's "America First" deportation policy and "Liberation Day" tariff war policy, while aimed at protecting American jobs and encouraging economic nationalism, have had significant unintended consequences that actually hurt the U.S. economy and benefit Asian-based companies seeking to establish or expand operations in the United States, especially in the manufacturing and technology sectors. This complex interplay of policies and economic effects reveals how global market dynamics shift under protectionist measures, often to the advantage of foreign competitors rather than domestic industries

.

Asia’s dominance in global manufacturing and technological innovation is a product of decades of strategic policymaking, investment in infrastructure, and a relentless focus on innovation. This essay examines the factors underpinning Asia’s leadership, with a specific emphasis on automotive manufacturing and electric vehicles (EVs). China, in particular, has emerged as a frontrunner in the EV sector, surpassing traditional leaders like Tesla through advancements in cost efficiency, battery technology, and autonomous driving systems. Drawing on academic, industry, and media sources, this analysis synthesizes the structural, economic, and technological drivers of Asia’s ascendancy.

America First Deportation Policy

47's "America First" approach emphasized strict immigration enforcement, including mass deportations of undocumented workers. This policy aimed to reduce the U.S. workforce's reliance on immigrant labor, particularly in industries like agriculture, construction, and manufacturing. However, the impact of these deportations has been multifaceted, negatively affecting sectors that rely heavily on immigrant labor.

Labor Shortages and Increased Costs: Many U.S. industries depend on low-wage, immigrant workers to fill labor gaps. For example, the agricultural sector saw significant declines in available workers after the increased deportation efforts, leading to reduced productivity, higher wages, and inflated costs of goods. In the manufacturing sector, companies struggled to maintain staffing levels, especially in fields such as electronics and textiles, which contributed to slower production times and higher operational costs.

Shift in Business Investment and Innovation: The harsh deportation policies discouraged foreign talent, especially skilled workers in technology and engineering fields, from coming to the U.S. This resulted in a reduction in the influx of high-skilled labor that is critical for innovation in industries such as IT and advanced manufacturing. U.S. companies faced challenges in hiring top global talent, which gave Asian companies a comparative advantage in maintaining a steady influx of skilled professionals into their tech industries.

Undermining Domestic Competitiveness: As U.S. industries struggled with labor shortages, Asian manufacturers, especially in countries like China, Japan, and South Korea, benefited from the availability of both low-cost labor and a highly skilled workforce, boosting their ability to scale production at a competitive advantage.

"Liberation Day" Tariff War Policy

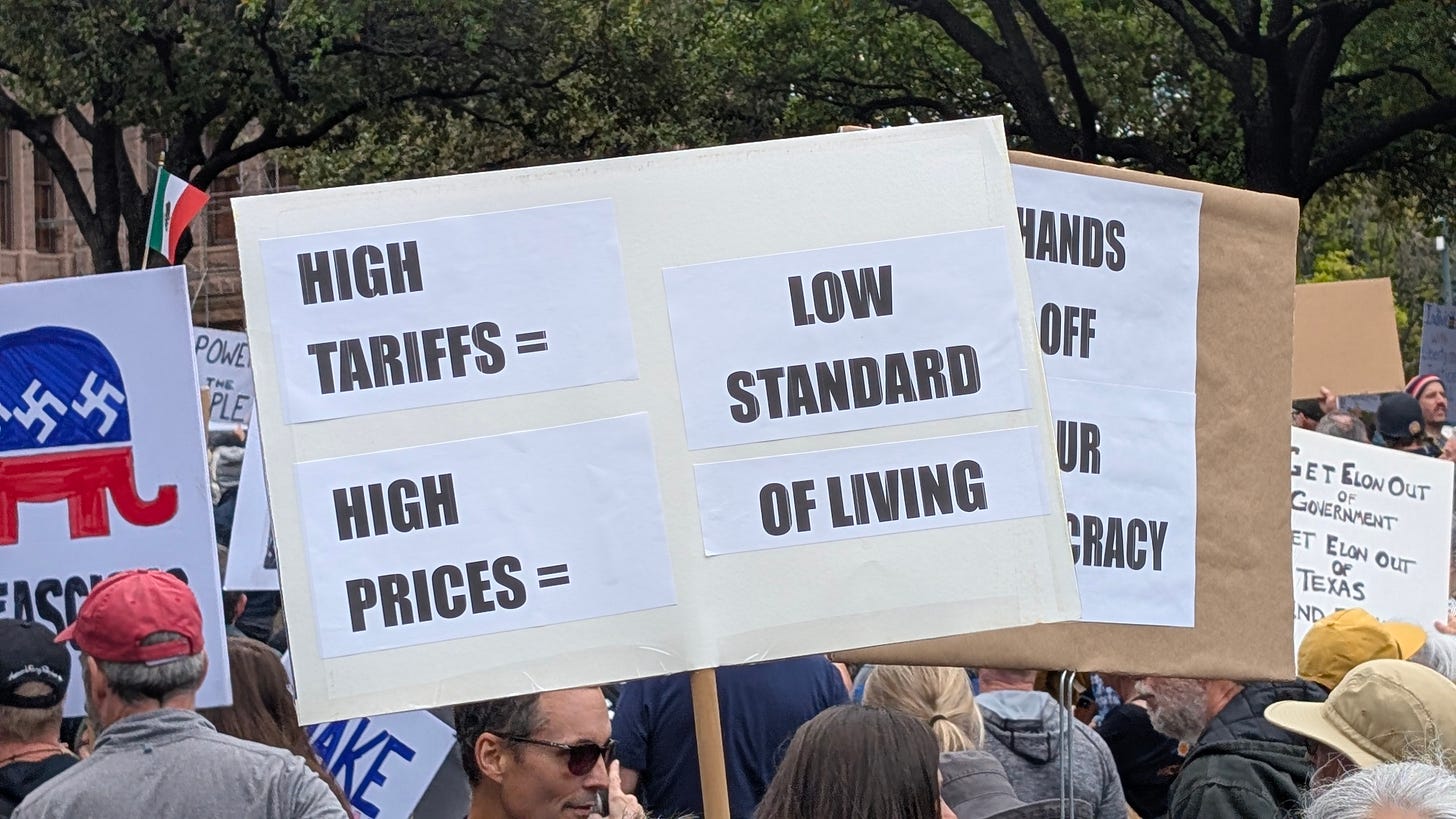

The "Liberation Day" tariffs imposed during 47's trade war with with the world were aimed at reducing the U.S. trade deficit with other countries and protecting American manufacturing. While these tariffs were intended to pressure others into making trade concessions, they led to several negative outcomes for U.S. businesses and provided significant advantages to Asian-based companies.

Increased Costs for U.S. Manufacturers: The tariffs raised the costs of imported goods, which directly impacted U.S. manufacturers who relied on Chinese-made raw materials, components, and finished goods. While some manufacturers tried to shift their sourcing to other countries, the high tariffs on Chinese goods made it more expensive to do business with alternatives, reducing the profitability of U.S. companies. In contrast, Asian-based companies with operations outside of China, especially those in Southeast Asia, were able to avoid these tariffs by producing goods in countries like Vietnam or Thailand, allowing them to take market share from U.S. competitors.

Reshoring and Diversification of Supply Chains: Although 47’s tariff policy intended to encourage reshoring of U.S. manufacturing, the immediate result was a shift in global supply chains rather than a significant return of production to the U.S. Asian-based companies, many of which had been considering reshoring to the U.S., began to view the tariff-induced instability as an opportunity to diversify their production. They invested in U.S. operations to avoid tariffs while still maintaining their low-cost manufacturing bases in other Asian countries. This dual presence allowed them to circumvent tariffs and gain access to both the U.S. market and global trade routes.

Accelerated Investment by Asian Tech Companies: The "Liberation Day" tariffs and trade policies created opportunities for Asian technology companies to expand into the U.S. market. Companies such as Taiwan’s TSMC, South Korea's Samsung, and China’s Huawei sought to increase their U.S. presence by building state-of-the-art manufacturing plants in the U.S., capitalizing on government incentives and a favorable regulatory environment for foreign direct investment. These companies were able to benefit from U.S. subsidies and local market access while avoiding the worst effects of the tariff war by making strategic investments in U.S. manufacturing infrastructure.

Incentivizing Asia’s Technological Leap: In the technology sector, U.S. protectionist policies pushed Asian companies to move more aggressively into the American market, particularly in areas such as semiconductors, smartphones, and consumer electronics. With the tariff-induced volatility affecting American manufacturers’ access to critical components, companies like TSMC and Samsung took advantage of this uncertainty by establishing semiconductor fabrication plants within the U.S., ensuring their continued access to the global supply chain. This shift not only helped Asian tech giants expand their influence in the U.S. market but also allowed them to benefit from government incentives aimed at supporting domestic production.

Historical Foundations of Asian Manufacturing Dominance

Post-War Industrialization and Government Policy

Asia’s manufacturing rise began post-World War II, with Japan pioneering high-quality automotive and electronics production. By the 1970s, Japan had become a global leader in steel, machinery, and consumer goods, leveraging government-backed industrial policies and a skilled workforce. This model was later replicated by South Korea, Taiwan, and Singapore, which focused on export-oriented growth and technological adoption.

China’s transformation into the "world’s factory" began in the late 1970s with market reforms, including the establishment of Special Economic Zones (SEZs) that offered tax incentives and streamlined regulations to attract foreign investment. Initiatives like "Made in China 2025" further prioritized automation, robotics, and high-tech industries, enabling the country to climb the value chain from low-cost labor to advanced manufacturing.

Workforce and Infrastructure

Asia’s competitive edge stems from its combination of low labor costs and a highly skilled workforce. Countries like China and India boast large populations with increasing technical education, allowing for scalable production of both labor-intensive and precision goods. Additionally, massive infrastructure investments—such as China’s Belt and Road Initiative—have streamlined logistics, reducing lead times and integrating regional supply chains.

Technological Innovation and Sector Specialization

Semiconductor and Electronics Manufacturing

Asian economies have carved out niches in critical industries. Taiwan produces over 60% of the world’s semiconductors, including 90% of the most advanced chips, while South Korea dominates memory chip production through firms like Samsung and SK Hynix. Malaysia has emerged as a hub for semiconductor packaging, attracting investments from Intel and Infineon. This specialization ensures Asia remains indispensable to global tech supply chains.

Automotive Manufacturing

Japan and South Korea established early dominance in internal combustion engine (ICE) vehicles, but China’s rapid pivot to EVs has redefined the sector. Chinese automakers like BYD, Nio, and Zeekr now lead in battery innovation, autonomous driving, and cost efficiency. For instance, BYD’s vertical integration—producing batteries, motors, and software in-house—has slashed costs, enabling its entry-level EVs to retail for under $10,000 in China.

Case Study: Chinese EVs Outpacing Tesla

Market Share and Sales Performance

In 2024, BYD surpassed Tesla in annual revenue (107billion vs. 97.7 billion) and total vehicle deliveries (4.27 million vs. 1.79 million), driven by hybrid models and aggressive pricing. Tesla’s reliance on premium pricing and stagnant innovation in China, where it faces tariffs and local competition, has eroded its market share. By contrast, Chinese EVs like the BYD Qin L start at 16,500, undercutting Tesla’s Model 3 (32,000) while offering comparable range and features.

Technological Advancements

Chinese EVs are pioneering breakthroughs in battery technology and charging infrastructure. BYD’s "blade battery," a lithium iron phosphate (LFP) design, improves safety and energy density while reducing costs. In March 2025, BYD unveiled a 5-minute fast-charging system for its Han L sedan, adding 250 miles of range—three times faster than Tesla’s Superchargers. Similarly, Zeekr’s advanced driver-assistance systems (ADAS), powered by Nvidia chips and lidar, are offered free to consumers, contrasting with Tesla’s $8,850 Full Self-Driving subscription.

Government Support and Domestic Market

China’s EV success is bolstered by subsidies, R&D grants, and infrastructure investments. The government’s push for "new energy vehicles" (NEVs)—including hybrids and hydrogen fuel cells—has created a $130 billion domestic market, the world’s largest. This scale enables Chinese firms to achieve economies of production unmatched by Western rivals.

Challenges and Global Expansion

Tariffs and Geopolitical Tensions

Despite technological prowess, Chinese EVs face barriers in Western markets. The U.S. imposes 100% tariffs on Chinese passenger cars, while the EU investigates subsidies allegedly distorting competition. However, firms like BYD are circumventing restrictions by establishing factories in Thailand, Brazil, and Hungary, targeting regions with growing EV demand.

Sustainability and Ethical Concerns

Asia’s manufacturing growth has not been without criticism. Studies reveal high lead levels in paints sold in China, India, and Malaysia, posing public health risks.

AI-Driven Manufacturing by Asian Companies in the U.S.

Asian conglomerates like LG Electronics have established advanced manufacturing operations in the U.S., leveraging artificial intelligence (AI) and automation to achieve superior efficiency and cost-effectiveness compared to traditional U.S. manufacturers. For example, LG operates "Lighthouse Factories" in Tennessee and South Korea, recognized by the World Economic Forum for their integration of AI, robotics, and data analytics. These facilities utilize Digital Twin technology for real-time production simulations, Autonomous Mobile Robots (AMRs) for material handling, and Vision AI systems to detect defects and monitor safety compliance. At LG’s Changwon plant, these technologies increased productivity by 17%, energy efficiency by 30%, and reduced defect-related costs by 70%.

LG’s competitive edge stems from its 66 years of manufacturing expertise, 770 terabytes of production data, and over 1,000 patents in smart factory solutions. By minimizing delays—such as avoiding a 10-minute production stoppage that could cost KRW 100 million (~$72,000) in refrigerator manufacturing—AI enables mass production at speeds unattainable by human labor. This model allows Asian firms to undercut U.S. competitors reliant on manual processes, particularly in industries like automotive parts, semiconductors, and consumer electronics.

Ramifications of U.S. Tariffs on Asian Manufacturing Relocation

President 47’s 2025 tariffs—ranging from 10% to 54% on imports from Asian nations like China, Vietnam, and South Korea—have disrupted global supply chains, prompting companies to relocate production to the U.S. to avoid levies. For instance, LG Innotek (an LG affiliate) recently partnered with Intel to deploy AI vision inspection systems in U.S. facilities, reducing defect detection time by 1.5x and achieving near-100% accuracy. Such moves signal a broader trend: Asian manufacturers are likely to establish more U.S.-based smart factories, combining tariff avoidance with AI-driven cost savings.

However, this relocation could harm U.S. firms that fail to adopt AI. Asian competitors entering the U.S. market will retain their technological advantages, such as:

Generative AI for predictive maintenance and quality control.

Industrial robots like LG’s Mobile Manipulator, which automates assembly and defect inspection.

Real-time data analytics to optimize energy use and logistics.

Without similar investments, U.S. manufacturers risk losing market share due to higher operational costs and slower production cycles. For example, 47’s 2018 washing machine tariffs raised U.S. appliance prices by 11%, but LG’s AI-driven U.S. factories could now offset such impacts through automation, leaving domestic firms vulnerable.

Targeting Conservative Red States: Labor Cost Arbitrage

Asian manufacturers are likely to prioritize conservative-controlled “red states” for new facilities due to their lower minimum wages, reduced unionization rates, and business-friendly regulations. For example, Tennessee—a right-to-work state with a $7.25/hour minimum wage—hosts LG’s Lighthouse Factory, which benefits from state tax incentives and cheaper labor. Similar strategies could be replicated in states like Texas or Alabama, where labor costs are 20–30% lower than in coastal states.

This geographic targeting creates a dual challenge for U.S. companies:

Labor Cost Pressure: Non-unionized, low-wage regions allow Asian firms to minimize expenses while maintaining high output via automation.

Technological Disparity: Even in low-wage areas, U.S. firms relying on manual labor cannot match the precision and scalability of AI-driven production.

Long-Term Impact on U.S. Companies

U.S. manufacturers that delay AI adoption face existential risks:

Profit Margin Erosion: LG’s AI solutions reduce defects and energy costs by up to 70%, enabling pricing strategies that undercut competitors.

Supply Chain Obsolescence: Asian firms using Digital Twins and IoT.nxt platforms can reconfigure production lines in hours, while U.S. firms using legacy systems require weeks or months.

Loss of Skilled Labor: As AI reshapes manufacturing, U.S. workers lacking AI literacy may struggle to adapt, exacerbating unemployment in non-automated sectors.

By 2030, the global smart factory market is projected to reach $268.46 billion, with Asian firms like LG targeting multi-trillion KRW revenues. U.S. companies that ignore this shift risk becoming obsolete, while those adopting AI could leverage partnerships (e.g., LG-Intel collaboration) to remain competitive.

Conclusion

While 47’s "America First" deportation and tariff war policies were designed to benefit U.S. workers and industries by promoting nationalism and reducing foreign dependency, they inadvertently hurt the U.S. economy. These policies led to labor shortages, higher costs for U.S. manufacturers, and a shift in global supply chains that benefitted Asian companies. Asian manufacturers, especially in technology and advanced manufacturing sectors, capitalized on the U.S.'s protectionist stance by diversifying their production bases, investing in U.S. operations, and circumventing tariffs. As a result, these policies have provided substantial advantages to Asian-based companies, fostering growth and technological advancements in regions outside of the U.S.

Asia’s manufacturing leadership rests on a triad of strategic policymaking, technological agility, and economies of scale. In the automotive sector, China’s EV industry exemplifies this model, combining cost efficiency, innovation, and government support to outpace global competitors. While geopolitical tensions and sustainability concerns persist, Asia’s entrenched supply chains and relentless R&D investment suggest its dominance will endure. As BYD’s CEO Wang Chuanfu noted, mastering core technologies like batteries ensures control over the industry’s future—a lesson Tesla and others are learning the hard way.

Asian manufacturers like LG are reshaping U.S. production through AI, turning tariffs into an opportunity to dominate domestic markets. Their focus on red states amplifies cost advantages, while U.S. firms lagging in automation face unsustainable competition. To survive, U.S. manufacturers must prioritize AI adoption, worker retraining, and partnerships with tech leaders—or risk irreversible decline.

References

Britannica. (1999, July 23). Asia - Manufacturing, Industries, Economies. Retrieved from https://www.britannica.com/place/Asia/Manufacturing.

Kingstec. (2024, November 13). The Evolution of Asian Manufacturing. Retrieved from https://kingstec.com/the-evolution-of-asian-manufacturing-innovation-and-global-dominance/.

Dezan Shira & Associates. (2025). Asia Manufacturing Index 2025. Retrieved from https://www.dezshira.com/asia-manufacturing-index.

CNN. (2025, March 26). It's the world's hottest car company. You can't buy one in America. Retrieved from https://www.cnn.com/2025/03/26/cars/china-byd-profile-tesla-rival-intl-hnk/index.html.

BBC News. (2025). Chinese electric carmaker BYD sales beat Tesla. Retrieved from https://www.bbc.com/news/articles/cd65d583qvzo.

LG Corporation. (2024, July 18). LG accelerates smart factory solutions business integrating AI with 66-year manufacturing expertise. https://www.lgcorp.com/media/release/27910

Hoskins, P. (2025, April 3). Asian stocks see their worst drop in decades after Trump tariffs. BBC News. https://www.bbc.com/news/articles/c934qzd094wo

Computer Weekly. (2024). LG integrates artificial intelligence into smart factory services. https://www.computerweekly.com/news/366596176/LG-integrates-artificial-intelligence-into-smart-factory-services

CBS News. (2025, April 2). Which products will be affected by tariffs? Here's what Trump's "Liberation Day" could make pricier. https://www.cbsnews.com/news/which-products-most-affected-tariffs/

PR Newswire. (2024, July 18). LG accelerates smart factory solutions business integrating AI with 66-year manufacturing expertise. https://www.prnewswire.com/news-releases/lg-accelerates-smart-factory-solutions-business-integrating-ai-with-66-year-manufacturing-expertise-302200239.html

Reuters. (2025, April 3). Sneaker and apparel retailers blindsided by tariffs on Asian factory hubs. https://www.reuters.com/business/retail-consumer/sporting-goods-makers-adidas-puma-slump-after-trump-announces-tariffs-2025-04-03/

Manufacturing Digital. (2024, July 22). LG Electronics enters smart factory market with AI tech. https://manufacturingdigital.com/articles/lg-electronics-enters-smart-factory-market-with-ai-tech

The Korea Herald. (2025, April 8). LG Innotek, Intel team up for AI-powered smart factories. https://www.koreaherald.com/article/10460474

Borjas, G. J. (2020). Immigration and the American worker: A review of the evidence. National Bureau of Economic Research.

Breznitz, D., & Zeng, J. (2020). The geopolitical economy of the United States and China in the era of trade wars. Global Governance.

Bown, C. P. (2020). The WTO and the crisis in trade policy: How the trade war with China threatens global trade. Foreign Affairs.

Chadwick, B. (2021). Asia’s manufacturing advantage: A closer look at the growing role of Asian companies in U.S. manufacturing. Asia Times.

Chin, J. (2021). Why Chinese companies are betting on U.S. manufacturing. Wall Street Journal.

Hill, C. W. (2021). International business: Competing in the global marketplace. McGraw-Hill Education.

Lowell, L. B. (2020). Immigrant labor in the United States: A comparison before and after the Trump administration’s immigration policies. Journal of Labor Economics, 38(4), 963-988.

Peri, G. (2020). The effects of deportation policies on labor markets and business investment. Journal of Economic Perspectives, 34(3), 123-146.

Jynx, that totally tracks. And honestly, I would be shocked if other congress persons didnt "secretly" do the same thing.